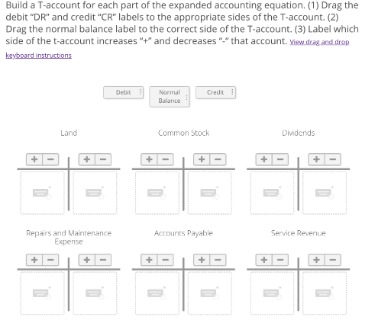

Content

Any lawyer who handles client funds that are too small in amount or held too briefly to earn interest for the client must participate in the Interest on Lawyers’ Trust Accounts (IOLTA) program. IOLTA accounts can only be kept at approved financial institutions. The interest earned from pooled IOLTA benefits nearly 100 nonprofit legal service organizations throughout California. IOLTA increases access to justice for individuals and families living in poverty and improves our justice system. Any time a law firm accepts payments for retainers from clients or handles money on a client’s behalf, it is put into an IOLTA.

If you’ve made the switch from paper cheques to electronic billing (e-transfer, credit card payments, that kind of thing), you can’t pass along the payment fees to your client’s IOLTA. All of these account types (IOLTA, IOLA, and Attorney Trust) have the same purpose. They are all used to separate the client’s money from the regular business or operating account. The difference is simply the interest – how much it accrues and who gets it.

What is an IOLTA Account?

One of the main benefits of an IOLA is that it allows attorneys to hold client funds without having to calculate and distribute interest payments to individual clients. Instead, the interest earned on the account is pooled and used to fund legal aid programs throughout the state. This means that attorneys can focus on their legal work without the added burden of managing interest payments. Unlike criminal defendants, people https://kelleysbookkeeping.com/ facing serious civil legal problems—such as domestic violence, housing insecurity, employment, government benefits, consumer debt, and elder issues—generally do not have the right to an attorney if they cannot afford one. Legal aid programs provide free civil legal services but, due to insufficient funding, legal aid organizations in Massachusetts are forced to turn away nearly 60% of eligible people seeking help.

To further prevent any errors, IOLTA debits and credits should be recorded using a double-entry accounting system. While keeping track of this manually can be a logistical nightmare, legal billing software can significantly streamline and simplify the process. Our Relationship Managers are ready to tailor financial solutions to suit your individual needs.

Ensure IOLTA Account Compliance with LawPay

It may also need to be titled as an “attorney-client trust account.” Whatever the rule for your jurisdiction is, do not deviate from it. Interest for the IOLTA program is generated only on those funds that would not have been substantial enough or held long enough to produce interest in excess of bank charges and administrative costs. Trust account funds which are sufficient to return income to the client may be put in separate interest-bearing accounts by the lawyer using the client’s Tax I.D. Whenever a law firm holds on to a client’s money, they hold those funds in a trust.

- The vast majority of banks not only offer IOLTA accounts, they also waive all service charges and fees on them.

- If an attorney’s status changes during the year such that he or she ceases handling client funds or begins handling client funds, Compliance Statements may, at that time, be provided to the Foundation.

- This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

- In the U.S., IOLTA programs are state-specific,[8] and operate under their own rules and regulations.

- Instead of earning interest on the client’s behalf, the interest from an IOLTA account is funneled to state bar associations to fund legal assistance for low-income clients and other charitable causes.

(iv) Be permitted to impose reasonable service charges for the

preparation and issuance of the statement. Alternatively, a participating bank what is an iola account used for may elect the Safe Harbor interest rate option, which is equal to 60% of the Federal Funds Target Rate or 1.00%, whichever is higher.

IOLTA Program Rules and Guidance

Pursuant to the Court Rule, after meeting expenses, at least 75% of net revenue is awarded to Legal Services of New Jersey, Inc. and through sub-grants to its local member Legal Services programs to support the delivery of civil legal services to New Jersey’s poorest residents. In addition, 12.5% of net revenue is awarded to the New Jersey State Bar Foundation to be used for purposes as stated in the Rule. The remaining net revenue is allocated by the IOLTA Board of Trustees to grants supporting civil legal assistance to income-eligible persons, improvements to the administration of justice, and law-related education.

And the penalties for breaking these rules can be severe, sometimes even leading to disbarment. (iii) Transmit to each attorney or law firm which maintains an IOLA

account a statement showing at least the name of the account, service

charges or fees deducted, if any, and the amount of interest remitted

from such account. (i) Remit at least quarterly any interest earned on the account

directly to the IOLA fund, after deduction of service charges or fees,

if any, are applied. (d) Notwithstanding the deposit requirements of this subdivision, no

attorney or law firm shall be liable in damages nor held to answer for

a charge of professional misconduct for failure to deposit qualified

funds in an IOLA account. The South Carolina Supreme Court created the Interest on Lawyer Trust Accounts (IOLTA) program to provide funds for law-related public service projects and programs designed to improve the administration of justice.

The IOLA fund’s revenue is driven by the prevailing interest rate. A. No. The program does not use interest money from all client trust deposits – only those that are nominal in amount or to be held for a short period of time. If these deposits were placed in separate, interest bearing accounts, the administrative costs to the law firm and the service charges of the financial institution – coupled with the resulting tax liability to the client – would more than offset any income earned. Often, the amount of money that a lawyer handles for a single client is nominal and/or held for only a short period of time. Traditionally, lawyers have placed these individual deposits together into pooled trust accounts, called general trust accounts.

Although the tax identification number of NC IOLTA will be assigned to all general trust accounts, the trust account and all checks should bear the name assigned by the lawyer/law firm to the account. The trust account and all checks must be clearly labeled as a “trust account” or drawn on a trust account. Lawyers may use identifying names on their accounts and checks, such as Real Estate Trust Account, General Trust Account, etc. The identifying account name may include the term IOLTA; however, it should be clear that the NC IOLTA program is not the fiduciary agent for the account.

Lawyers must use their own good-faith judgment to determine whether a given trust deposit is of sufficient size or duration to justify placement in a separate, interest-bearing account, with interest payable to the client. In the New Jersey IOLTA program, you retain full discretion in this area, and make fiduciary decisions based upon standard criteria. In all provinces IOLTA generated from pooled trust accounts is remitted to the applicable law foundation of the province. Every state has an IOLTA program, and it’s likely that the financial institution where you opened your regular business checking account also offers IOLTA accounts. Lawyer trust accounts are tricky—they have very specific rules around what you can and can’t do with them.

- However, attorneys in New York are protected from liability if they deposit funds into an IOLA account in good faith, thanks to a statutory hold-harmless provision.

- Prior to IOLTA, these nominal and short-term funds were combined and placed into a pooled, non-interest-bearing checking account.

- The IOLTA program has generated more than $2 billion nationwide for some of our country′s most vulnerable residents.

Violating rules related to IOLTA accounts in your jurisdiction can come with serious consequences. It’s very difficult to defend against the allegation of misappropriation of client funds. The defense attorney will have to show that you’re disorganized and simply don’t have the skills to handle a trust account. That’s not something you want said about you or your practice (even in the name of protecting your career). This particular rule is covered in detail in every jurisdiction. Most jurisdictions require that IOLTA accounts be held in the state where the matter takes place.

History of the Commission on IOLTA

Payment on multiple accounts should be combined into one payment and payments should be remitted through the ABA Clearinghouse or wired. For ACH and wiring instructions, please contact the IOLTA office. These consultants usually have experience dealing with IOLTA, and rules in most states don’t require them to report ethics violations to the bar. While each IOLTA program follows similar guidelines, rules do vary by state. (For example, state Supreme Courts have made IOLTA mandatory in some states and voluntary in others.) That’s why it’s important to consult your State Bar Association and a professional accountant before finalizing your accounting setup for IOLTA. Please note that the information provided on this website is for general informational purposes only and is not intended to provide legal, financial, or tax advice.

- That’s not something you want said about you or your practice (even in the name of protecting your career).

- Keeping business and trust accounts separate is simply the only way to reduce your IOLTA compliance risk.

- COLTAF’s Leadership Banks maximize resources for civil legal aid by providing a premium rate of return on COLTAF deposits.

- Business costs or costs billable to others are the responsibility of the law firm and should not be charged against client funds in the account or against the interest or the earnings credit of an IOLTA account.

Participating attorneys can support the IOLTA Program’s mission of making funds available to support legal aid for the indigent by doing business with our preferred banks or encouraging their bank to contact us about becoming a preferred bank. Lawyers and legal paraprofessionals must comply with Supreme Court rules relating to their conduct, including how they manage their IOLTA accounts. They also may keep IOLTA accounts only at regulated and approved financial institutions whose deposits are federally insured, who agree to comply with required reporting, and to transmit funds as required to the Foundation. Nearly all IOLTA programs in the United States use IOLTA revenue to provide grants to organizations for the purpose of providing legal aid in civil matters to low-income residents; many also use IOLTA revenue for grants to help improve the administration of justice in their states.